How To Scan Stocks To Trade And Setup Your Day Trading Watchlist

Whether you’re a part-time or full-time trader, you need to be able to build your stock trading watchlist and game plan to win the trading game. So How do you create a stock watchlist? How do I find profitable stocks to trade? What scanner do you use? And how do you use these tools to make it rain Lamborghinis?

I’m so glad you asked because not having a stock watchlist is like walking into a grocery store hungry, without a shopping list. What happens? You panic and buy anything and everything you see! In trading, that’s a recipe for blowing up your account. (”Cough, cough”, don’t tell my mom.) I still go to Walmart and spend money on things I don’t need…)

As I’ve often talked about in the past, most of the work done in trading happens outside of market hours. That’s where you should do most of your preparation, charting, and journaling. So in this blog post, I’m going to share:

How you can find the best stocks to trade every day

My step-by-step process of setting up stock scanners

How to use free tools to build a watchlist without any fancy premium scanners or news platforms

How to plan out your trades on your charts with the help of your watchlist

3 criteria to find out better stocks to trade

Things to avoid as a day trading beginner

This is a process that I’ve been using since more than 7 years ago when I was a beginner day trader. I’m going to break it down to a few simple steps. Note I said “simple”… but not “easy”. Trading is never easy, but you can increase your success rate greatly by having a plan.

To start, I have a few different scanner set-ups to help me make a watchlist during pre-market sessions every day.

How you can find the best stocks to trade every day: overnight gap-up scanner

And today, I’m going to share with you my favorite “overnight gap-up scanner”.

If you are new to my channel, I always recommend that my beginner traders focus on trading large-cap stocks, as they are way less volatile than penny stocks and micro-caps.

The first step to building your watchlist is to focus on the stocks with the most volume. And often that is simply by scanning for stocks with the biggest percent gap up overnight.

What are large-cap gappers, and why should you be trading these stocks?

We often call stocks with a market capitalization of more than $10 billion large-caps. For example, these are stocks like Apple (AAPL), Tesla (TSLA), and Amazon (AMZ).

For this scanner's criteria, we are specifically focusing on large-cap gappers. I usually recommend that traders focus on these higher-priced, higher-market-cap names because they are less cyclical than small-cap stocks and are more predictable.

If you focus on small caps, there will be months when you don’t see any good gappers. But large-cap stocks are way more consistent. If you scan for overnight gap ups or gap downs, you will almost always find something worthwhile to trade.

What is a gap-up?

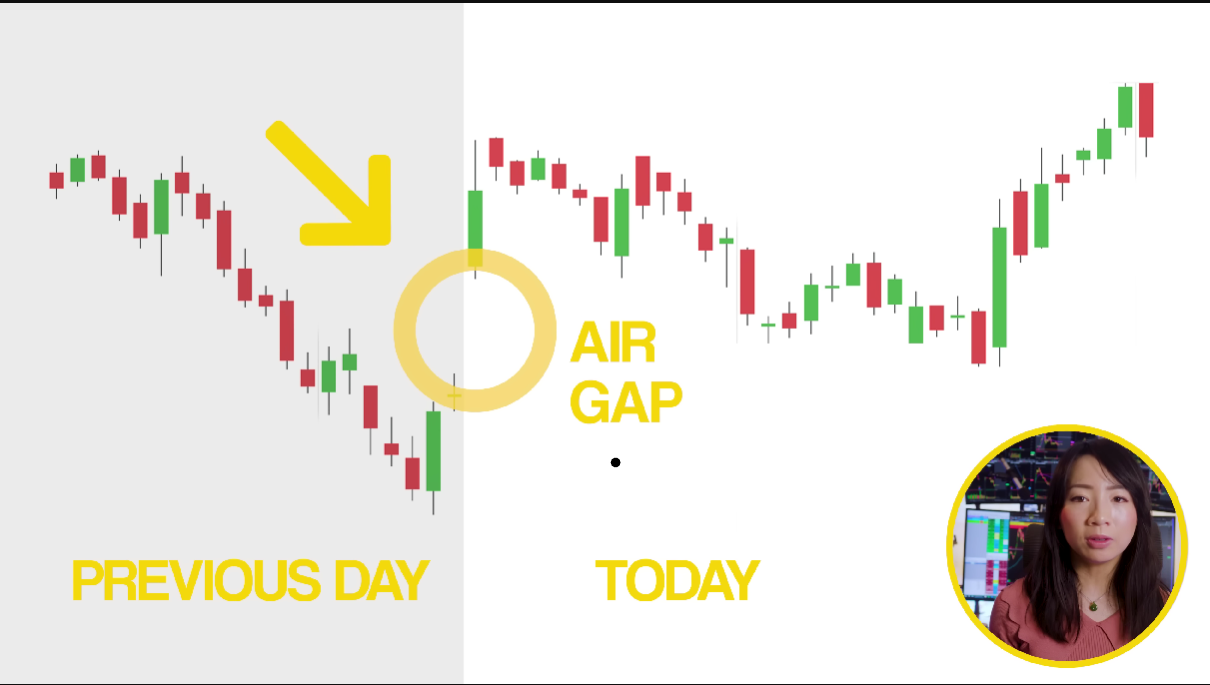

In trading, a gap-up means a stock opens above the previous day’s closing price, resulting in an air gap between the pre-market trading price and the previous day’s closing price.

Example of gap-up—Tesla on March 2nd-3rd

As you can see in this example, TSLA stock closed at around $191 on this day. The next morning, premarket trading caused it to gap up to $195.

This is what we call a gap-up because Tesla is opening at $4 higher than the previous day’s close.

Why do I love large-cap gappers? Most of the time, a stock gaps up due to a positive catalyst. The catalyst and big overnight percentage move often lead to a lot of range and volume after the opening.

My step-by-step process of setting up stock scanners

Okay, Shay… I get that we need to look for gap-ups, but how do we do that?

Well, that’s where a very handy tool called the stock scanner comes in.

Stock Scanner Tool: Stox.io

I’ll walk you through how to properly analyze stocks to trade with these 4 key metrics. And you can apply this knowledge to improve your trading and stock selection tomorrow.

Knowing these 4 metrics is extremely important. And not only can they allow you to find the right stocks to trade... But also AVOID stocks that can potentially lose you money.

Okay, let's get started.

Right here on my stock scanner platform, Stox.io, you can see all my preset scans for small caps and large caps.

I want to show you what I see after I click a scan result premarket. So the first key metric you need to know when selecting stocks to trade is:

Market cap

This is important for traders, not for valuing companies to invest, but to figure out whether the stock you are looking at is a large-cap/midcap, or small-cap stock.

How I trade small caps is very different from large caps. They have different behaviors. For example, if you have a breakout strategy, that's probably best applied to large-cap stocks. If you have a consolidation long strategy, that could work for small caps.

How I categorize these: anything under 800m is considered small-cap, and over 800M is midcap/large cap which I trade the same way.

Float

Float - refers to the available shares that are publicly available on the open market — not those held by insiders and controlling investors.

Generally speaking, the lower the float of the stock, the more volatile it is. Look at this stock with 800K shares float, that's a lot fewer shares to move compared to something like AAPL, with over 15.4 Billion shares.

The stock market is all about supply and demand. When there are fewer shares available to be traded, and a lot of people are buying the stock, the stock's prices can be driven up in an explosive way.

Some traders primarily trade low float small cap stocks. If you want to do the same, you can create a scanner on Stox.io that scans for float below 15M, and market cap below 800M.

Gap % and Volume

These two metrics kind of go hand in hand. So let's go over them together. Gap % is the percentage move from the previous day's closing price to premarket price before the open. This is an important metric when you’re scanning for both large-cap and small-cap stocks premarket.

The reason you want to scan for stocks that have gapped up with higher than average volume is that this is perhaps the best indicator that the stock will provide you momentum and range after the open.

Imagine if you did all the planning to trade a stock and the market opens… Then the stock just moves like 1 cent every 10 minutes. You don't want that; you cannot make money if the stock does not move. That's why you want to scan for stocks that have gapped up, with volume. This is the scanner setting I would use for that on Stox.io.

For small caps, besides what you learned earlier about float and market cap, I would add a parameter to scan for stocks that have gapped up at least 10%, as well as trading at least 200K volume premarket. Once the results show up, I'll click and sort by gap%. The scanner will then list your results from high to low.

For large caps, I would scan for at least 3% gap, as well as 20K. Large cap stocks tend to trade lower volume during the premarket gap compared to small caps. Now very important here, GAP % only applies to premarket trading hours, from 4 am to 9:29 am ET.

After the open, let's say if you’re scanning for stocks that are moving during the middle of the day at 11 am ET, you want to scan for change % instead.

Change % is the move from the previous day's closing price to the current trading price during regular hours. That means it does not consider the premarket price. I mean you don't need to anymore after the market has already opened, right? That's why I scan and sort stocks by the highest % mover after about 10:30 am, to look for stocks that started breaking out after the open.

You can use the exact same scanners with the same criteria on Stox.io. We are doing a special launch promotion for 40% right now. The promo will expire in 10 days. So make sure to check it out on Stox.io.

When I first started trading part-time, I didn't immediately start using premium scanners. However, I will recommend some free tools later in the video.

After about two years as a beginner, I transitioned to paying for premium scanners, and it was a game changer. Now, I can find all the gappers, average volume, float, market cap, short %, and average daily volume within seconds.

Using premium scanners saved me so much time, especially as a part-time trader where every second counts. It allowed me to build my morning watchlist faster and more efficiently. Plus, it's a tax write-off!

How to use free tools to build a watchlist without any fancy premium scanners or news platforms—Webull, Thinkorswim, Finviz

For all the beginner traders out there, don't worry; I've got you covered. When you're just starting out, I highly recommend minimizing expenses as much as possible. I'll show you how to build a scanner using free tools, without any fancy premium scanners or news platforms.

I know the struggle because I was once in your shoes. In my first year of trading, I didn't have the funds to purchase scanners. So, here are my recommendations for free market scanners that you can use to find suitable gappers for long strategies:

Webull

Webull offers a free stock scanning feature on their desktop platform. While it may not provide all the details, such as float, average daily volume, or short interest, it effectively scans for high percentage gappers each day before the market opens.

(If you want to learn more, the Webull stock screen tutorial is available at the Humble Trader Academy!)

Thinkorswim

Next is Thinkorswim. They have a built-in scanner. They are not perfect, but they would be able to find most gappers every day.

You can check out the TD ThinkorSwim Tutorial 2023 here if you are interested in learning more.

Finviz

One free method I use to scan for stocks to trade is through Finviz. This platform offers a great screener and allows you to visually sort through all the charts with your own filters. You can use this for mid-cap and large-cap stocks as well.

Here are a few things you can do with Finviz for free:

Check Top gainers or losers and their volume on the homepage.

Use Finviz stock screeners to find stocks you want to trade.

Here’s a walk-through of how to do it:

To begin, click the screener located at the top.

Under the “market cap” category, select either nano, micro, or small cap.

Next, consider the stock's “relative volume”, which is the daily trading volume relative to the average trading volume in the last 3 months. If the relative volume is greater than 1, this indicates that more people are taking an interest in the stock and getting involved in the market.

Humbled Traders Tips: Increased volume precedes breakouts

One important note to keep in mind is that a stock breakout is usually accompanied by an increase in volume. Without such an increase, the stock price is likely to bounce back from its high and fail to break out.

Next, let's consider “price”. Personally, I don't like trading stocks that are below $1, as my historical performance with those has been horrible. So, I avoid all true penny stocks and OTC stocks.

Also, you can add additional filters, such as “short interest” and “sector”, at the top to get more specific results.

Once finished, the FINVIZ screener will give you potential penny stocks to trade. But next, if you want to look at these charts on a daily time frame to look for setups. So click charts here, and “bam”! You can see all these penny stocks visually.

Is Finviz enough for day trading?

I think it's great for swing trading or if you trade midday and just need to see the top percentage movers. However, it's not very useful for pre-market trade planning. If you want to plan for stocks the next morning, then it's totally fine. One downside is that it doesn't provide real-time data for pre-market screening unless you pay for the elite version.

How to plan out your trades on your charts with a watchlist

Now that we know how to scan for stocks that are gapping up for potential trades using either free or premium tools, let me show you how to plan your trades on your charts with the help of your watchlist during pre-market or regular trading sessions.

Choose the stocks you see on your large-cap gap-up scanner

Do a basic technical analysis. Specifically, look for stocks that are breaking out of some daily resistance to the upside

Use levels to plan your risk, potential target, and entries

Here’s some advice on planning your trade:

Ideally, I want to see stocks that are just about to break out and are not too extended.

Marking the key levels is important and should be noted in your daily watchlist

The second condition I will be looking at is the volume to see if it is growing with the uptrend.

Here’s a short setup example of BBIO:

The stock is gapping up to the daily level of around $18, as can be seen from the daily chart. This level is important, so once you draw it, take a look at how the stock is reacting to it intraday. Before the market opened, the stock went to $23, sold out to $16, and kept on testing that $18 level. Therefore, $18 is going to be your key level for the stock.

At the open, the stock broke above $18 but kept on selling off, sold off the key level, and then tried to retest it again. But it sold out for $16–17, and once again, over here. If a stock is unable to hold that key level on the daily chart, then it's a short setup.

In this example, as the stock cannot hold that $18 key level, I would not be buying it. Instead, it would be a good short to the $18 key level and look for a downside to some support from pre-market and the $16.8, and eventually below $16.

3 criteria to find out better stocks to trade

Now let’s filter out these candidates further. On the daily chart, there are three specific things I’m looking for.

Stock bottom curling or consolidation on the daily chart

Why? Because those setups usually provide the greatest room to the upside and can offer us at least 3 to 1 risk to reward. In trading, I’m not looking to take every setup that pops up. I only want to enter trades that allow me to risk little and make a lot. That’s why

Increasing volume on the daily chart

Because in order to have a penny stock break out of the range to the upside, we need more people buying. Very simple. That's why volume is so important. So with the first two criteria, let’s filter through the sixteen results we got. (Once you get the hang of it, you can go through all these daily charts on Finviz real quick!)

Whether the stock has a low float and high short interest

This criterion is not as important as the first two. But it can definitely be the icing on the cake. A stock with a low float and high short interest has the potential to break out above its price levels and can definitely squeeze to the upside.

Things to avoid as a day trading beginner

Scanners or watchlists are not buy or sell signals

First of all, let me be clear: the scanner or watchlist should not be treated as buy or sell alerts. They are guidelines that are pre-planned. If the stock doesn't behave according to your plan, then don't trade it.

Know your key levels

Prepare them during pre-market. Remember, failing to plan is planning to fail. If you show up to the market open with no support and resistance drawn out, how will you know where to enter, take profit, or manage risk? It's no different than chasing chat room alerts.

Do not force trades on everything that is on your watchlist

Pick one or two to focus on at a time. Once again, do not go down the grocery aisle and try to buy everything. Know your trading strategy, be patient, and look for the potential setup of your trading strategy on the chart.

So now you know how to scan, find the best stocks to trade, and create a watchlist. But that’s not enough; you need highly profitable strategies and risk management plans that can level up your trading performance.

If that’s you, then make sure to check out the Humbled Trader Community for more in-depth trading knowledge. Or check out more of my trading strategies with step-by-step tutorials in other videos.